A power vacuum in Venezuela’s leadership in the US has left bond holders with no one to negotiate the country’s $60 billion pile of defaulted debt, according to a lawyer who advises the largest group of creditors.

By Yahoo Finance – Ezra Fieser and Nicolle Yapur

Feb 16, 2023

Investors that own government and state oil company bonds are open to negotiating a so-called tolling agreement on the bonds. That would effectively extend an approaching statute of limitations and give the parties time to work on a restructuring, said Richard Cooper, an attorney at Cleary Gottlieb Steen & Hamilton LLP.

The firm represents the Venezuela Creditor Committee, a group of mostly institutional investors that have held more than $10 billion of the debt.

However, the creditors don’t have a government to negotiate with after opposition lawmakers removed Juan Guaido in December. Washington doesn’t recognize President Nicolás Maduro either, having cut ties in 2019.

“A tolling agreement is difficult because of the end of the interim government and lack of clarity of who’s the recognized government,” Cooper said during a rare event on Venezuela’s debt organized by Americas Society/Council of the Americas in New York.

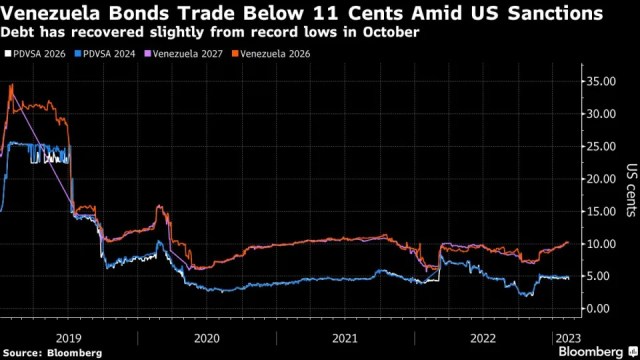

Any attempts at an eventual restructuring would face a difficult path: The bonds are deeply distressed, trading below 11 cents on the dollar. And US traders are currently banned by sanctions from buying the debt.

The creditor situation adds to the fallout from the removal of Guaido, who was backed by Washington and other Western governments in 2019 and given control of government assets in foreign countries. Last week, the State Department took custody of Venezuela’s Embassy and diplomatic residences in Washington and New York, saying foreign diplomats have to be appointed by a president.

For creditors, the future of one of the world’s largest piles of defaulted debt is at stake. The government and state oil company PDVSA stopped paying on roughly $60 billion of bonds in 2017. Billions more of interest has accumulated since.

As the sixth anniversary of the default nears in October, investors are getting ready to sue in US courts before a statute of limitations expires, which would strip them of their ability to enforce repayment of the obligations.

A tolling agreement would push that deadline down the road, which Cooper said would “basically avoid unnecessary expenditures” of costly lawsuits.

Maduro has repeatedly said his government is open to negotiations with creditors. Vice President Delcy Rodríguez offered to waive the statute of limitations on almost all Venezuelan bonds in 2020.

The offer failed to gain traction because Maduro was not recognized and the US had imposed economic sanctions against Venezuela.

“It’s very difficult to have an agreement where there’s a lack of clarity about legal representation,” said David Syed, an attorney at Denton’s Europe LLP, who advises Venezuela’s Finance Ministry and PDVSA. Syed said he was not appearing at Wednesday’s conference on behalf of the government.

“I think the willingness is still there if we have the proper discussion,” Syed said about the tolling agreement.

The Venezuela government didn’t immediately return messages seeking comment.

Cooper said even if a tolling agreement is eventually reached, any debt negotiations will be a drawn-out process.

“There is no script for the eventual restructuring of Venezuela,” he said. “This is going to be really complicated if and when it happens.”

…

Read More: Yahoo Finance – Venezuela Power Vacuum in US Raises Questions for Creditors

…